What are Mutual Funds (MF) ?

Mutual funds are a way for a group of people to pool their money together to invest in a variety of assets like stocks, bonds, or other securities.

These funds are managed by professional money managers who make investment decisions on behalf of the investors.

Each investor owns shares in the mutual fund, and the value of those shares is determined by the performance of the underlying assets.

How do MF work?

When you invest in a mutual fund, your money is combined with the money of other investors. The fund manager then uses this pool of money to buy a mix of investments according to the fund's objectives.

For example, if you invest in an equity mutual fund, your money might be used to buy stocks of different companies.

As the value of the investments in the fund goes up or down, so does the value of your shares. If the investments perform well, the value of your shares increases, and you may earn dividends or interest payments.

Conversely, if the investments perform poorly, the value of your shares may decrease.

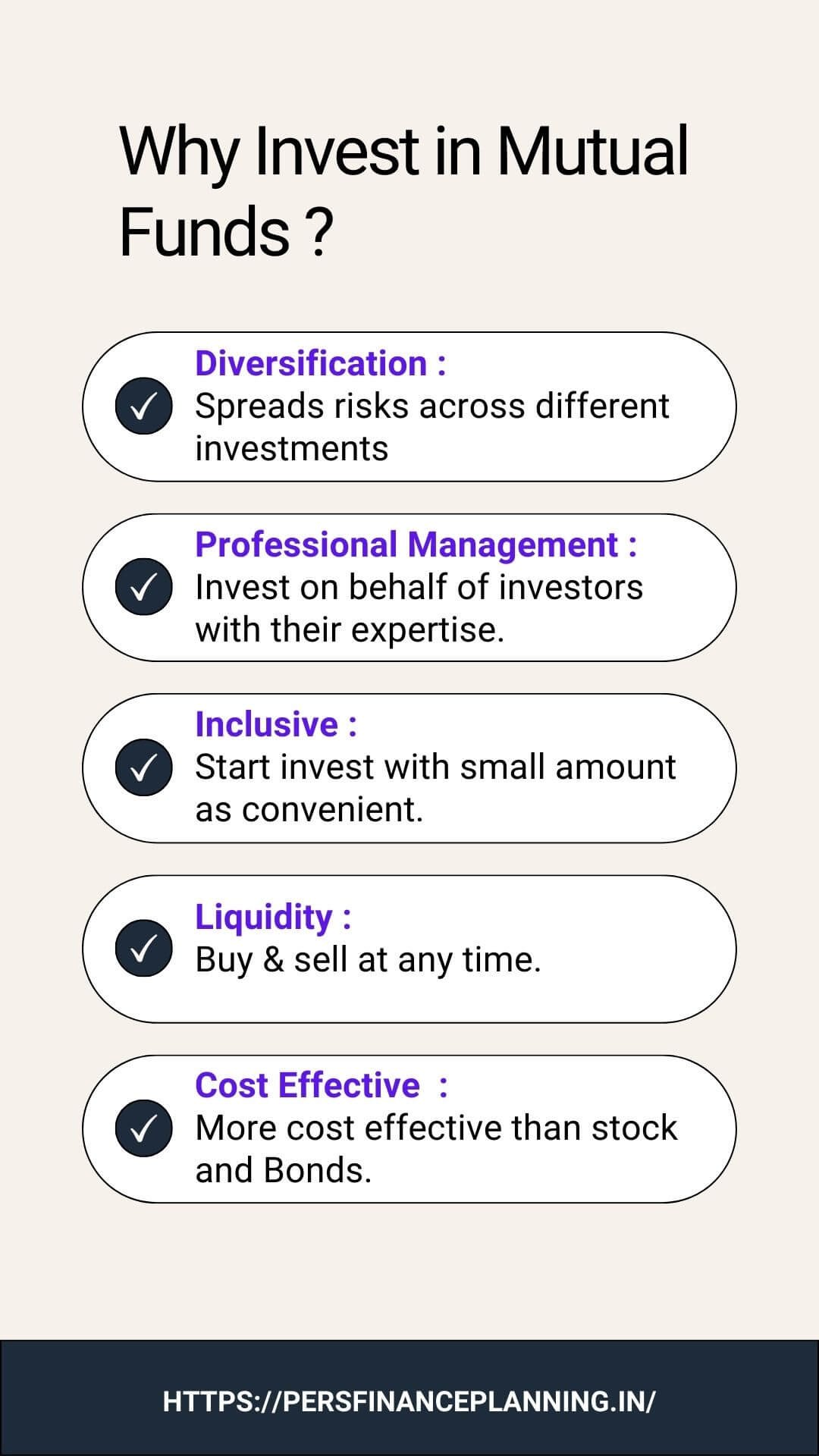

Benefits of investing in MF :

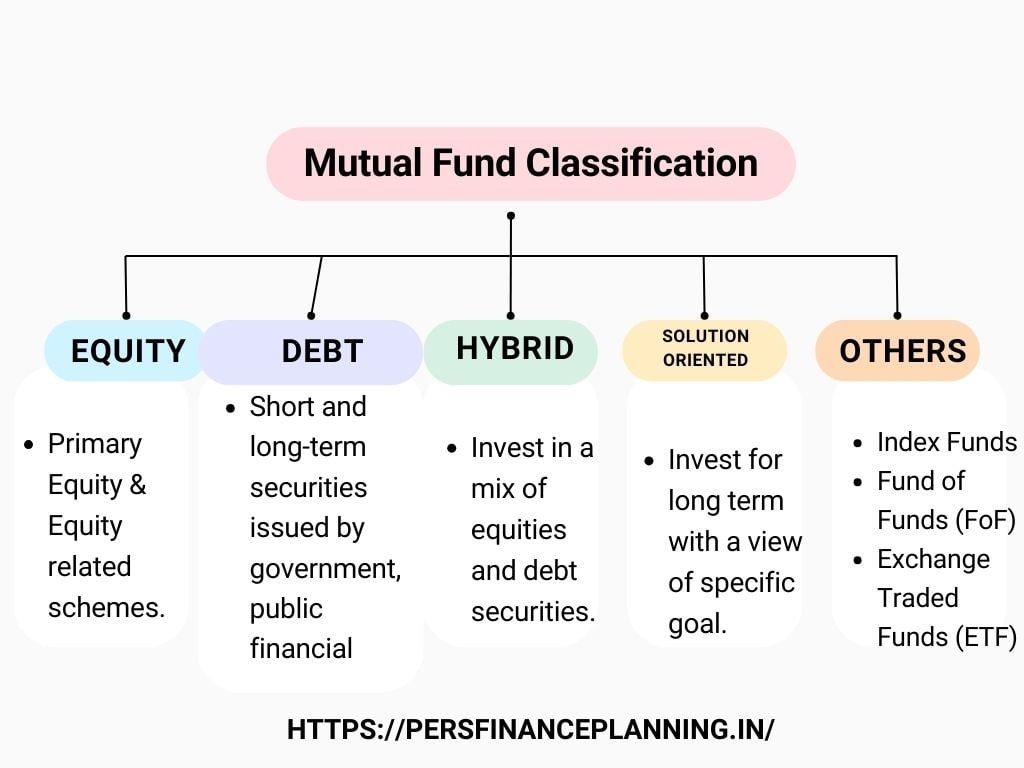

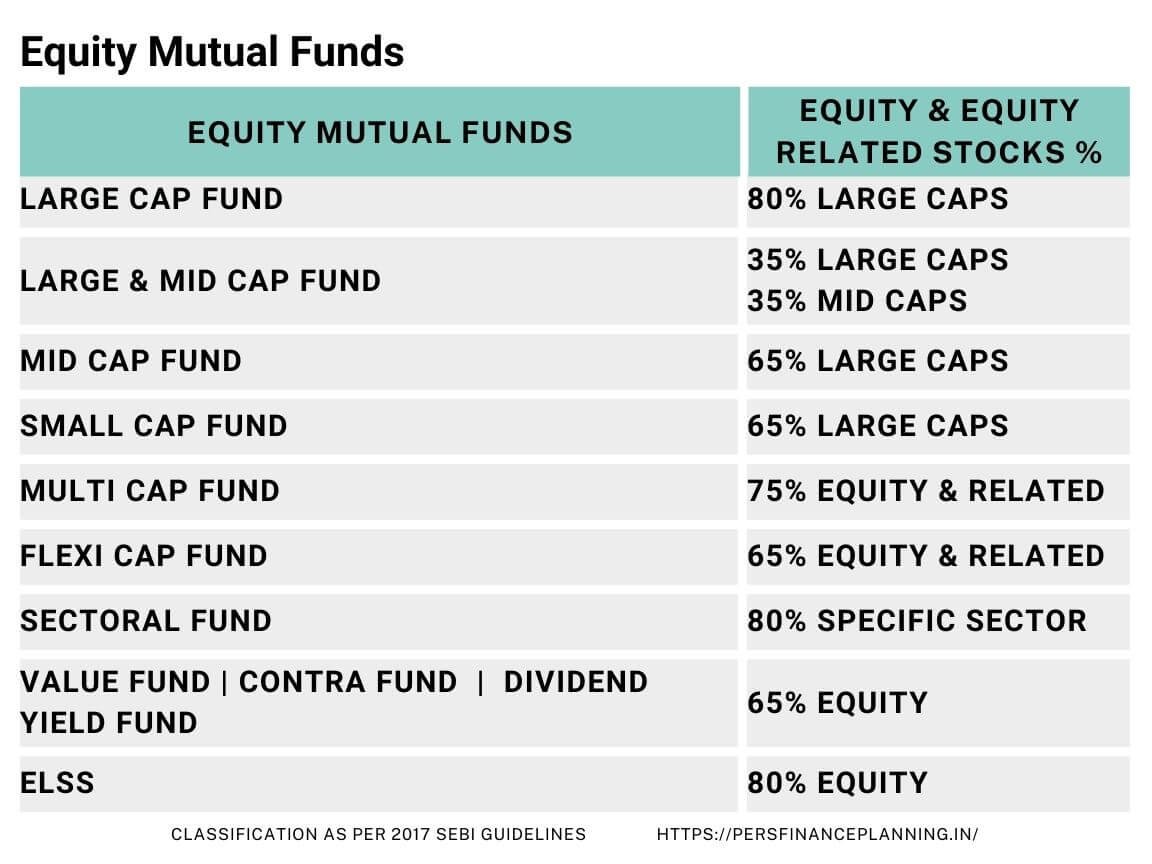

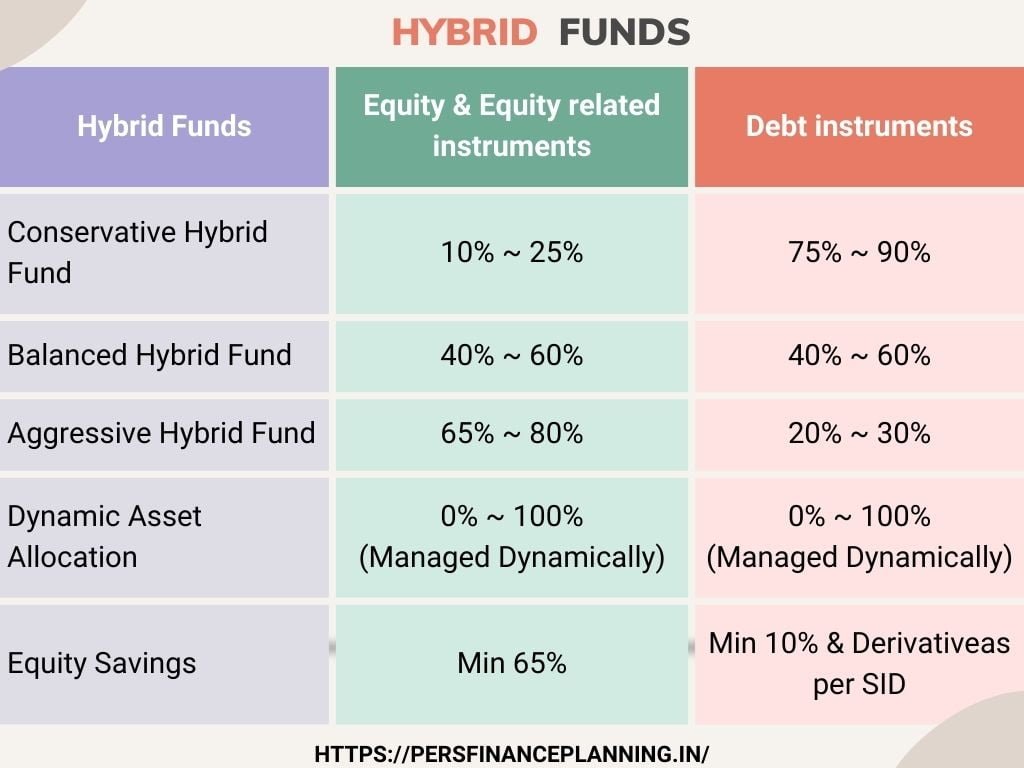

MF Classifications :

In October 2017, SEBI introduced regulations aimed at restructuring and simplifying the landscape of mutual funds. These regulations were devised to bring more clarity and coherence to the mutual fund industry.

By June 2018, all these new rules were in place for every mutual fund company and every mutual fund complied with new rules.

The overarching objective of these regulations was to enhance transparency and ease of understanding for investors. SEBI's aim was to create a safer and more accessible investment environment, where investors could make informed decisions with confidence.

Through these measures, SEBI sought to empower investors and foster greater trust and participation in the mutual fund market.

Mutual Fund Investment Styles & Strategies

Asset allocation strategies: growth, income, balanced, etc.

Asset allocation strategies are essential for managing risk and achieving financial goals in mutual fund investments. Tailoring asset allocation strategies to individual financial goals, time horizon, and risk tolerance is crucial for optimizing investment outcomes.

| Type of Allocation. | Focus Area on.... |

| GROWTH | Capital appreciation through investments in high-growth assets like stocks or equity funds. |

| INCOME | Prioritizes generating regular income by investing in bonds, fixed-income securities, or dividend-paying stocks. |

| BALANCED | Aims to achieve a mix of growth and income by diversifying across different asset classes. |

Other Styles: Include momentum investing and contrarian investing, each with unique strategies based on market trends and sentiment.

Choosing Right Mutual Fund:

Considering factors like investment goals, fund performance, manager expertise, fees, and ease of buying and selling ensures that investments fit well with personal circumstances.

By carefully evaluating these factors, investors can reduce risks, maximize returns, and build a strong investment portfolio that meets their goals. Ultimately, selecting the best mutual funds sets the stage for long-term financial stability and confidence in reaching desired outcomes.

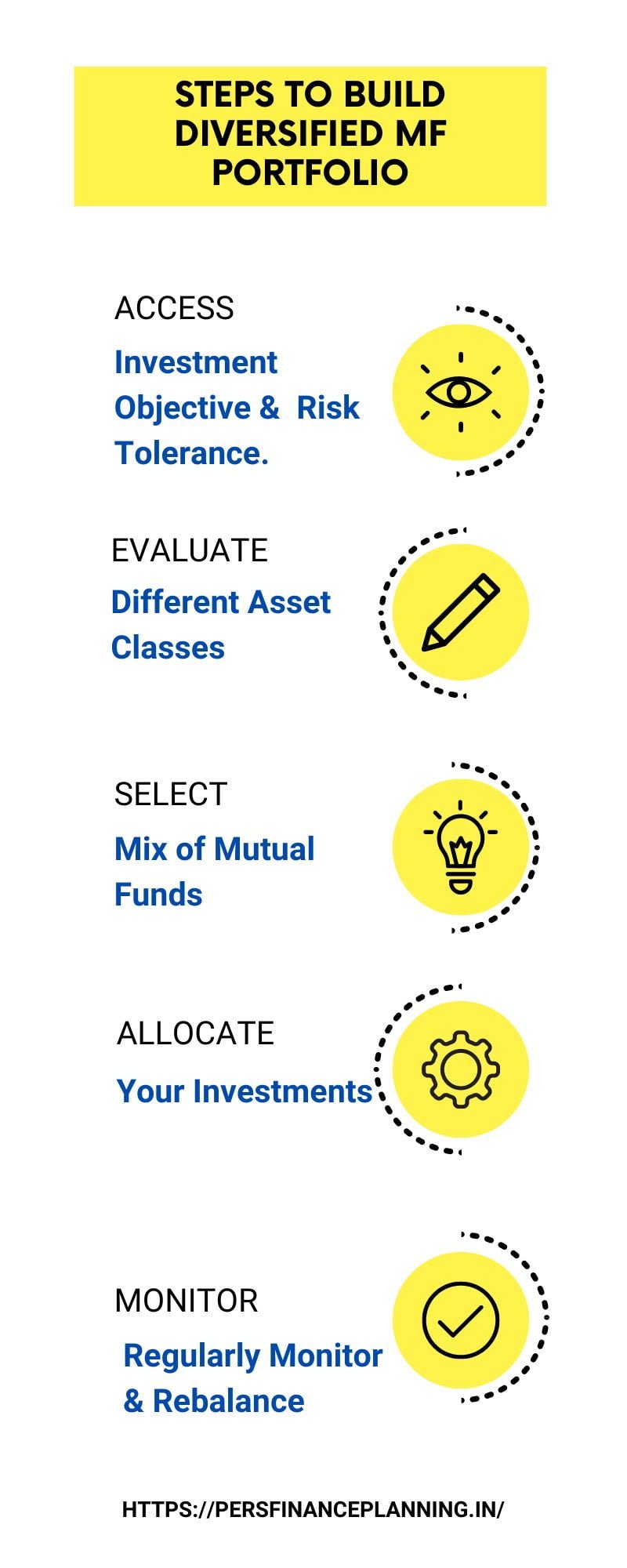

Creating a diversified portfolio using mutual funds.

Diversification and asset allocation are crucial in mutual fund selection for managing risk and maximizing returns. Diversification spreads investments across different assets to reduce the impact of market fluctuations.

Asset allocation determines the right mix of investments based on individual goals and risk tolerance. Together, these strategies help build a well-balanced portfolio that can withstand market ups and downs, leading to more consistent long-term performance.

Monitoring & Rebalancing of Mutual Fund Portfolio

Monitoring :

It is like checking your garden regularly to make sure everything is growing well. You keep an eye on how each investment is performing and whether they're doing what you expected.

If something isn't growing as expected or looks unhealthy, you make adjustments to keep your portfolio healthy and on track.

Rebalancing:

Just like you trim overgrown plants and replant new ones to maintain a balanced garden, rebalancing your portfolio involves adjusting your investments.

If one type of investment grows too big and starts taking over, you trim it back by selling some and use that money to buy more of the investments that are smaller. This helps keep your portfolio balanced and aligned with your goals.

The requirements of rebalancing and monitoring are addressed by a trained and certified Mutual Fund distributor.

Ideal Way of Investment in Mutual Funds [ SIP ]

A SIP is a plan of investing in mutual funds in which you invest a fixed amount in them on a regular basis, like monthly, quarterly, or at such a frequency which you are comfortable with. A SIP is a mode of investment for wealth creation over time by taking advantage of market fluctuation.

SIP, does rupee cost averaging over a long period of time.

This disciplined approach encourages long-term investing, reduces the risk of timing markets, and helps achieve your financial goals steadily and systematically.

Explore the various strategies of SIP and how they can help you built wealth.