Personal Finance & Wealth Management – Smarter Mutual Fund and PMS Planning for Your Life

Helping working professionals, NRIs, and families make confident financial decisions through clear, customised wealth strategies.

From Mutual Funds and Portfolio Planning to End-to-End Wealth Management — everything is simplified, Personalised, and backed by Chartered Wealth Manager expertise.

NITIN WALI -Chartered Wealth Manager

Transparency : Clarity in Every Step

No hidden agendas — every product, fee and risk is explained before you invest.

Holistic Approach : 360° Personal Finance Planning

Your plan integrates taxes, insurance, estate needs and future goals into one clear roadmap.

Trust & Reliability: Safe, Disciplined & Goal-Driven Execution

AMFI & APMI compliant processes with disciplined, rules-based execution.

Personal Finance and Wealth Management . That Fits Your Life - Not the Other Way Around

I don’t sell products —

I build financial plans aligned to your goals and comfort with risk, so you always know why you’re investing.

AMFI Certified Mutual Fund Distributor

Certified to recommend mutual funds with transparency and a client-first approach — focused on your goals, not product pushing.

APMI Registered PMS Distributor

Authorised to offer SEBI-regulated PMS, giving you access to exclusive, research-driven portfolios tailored for long-term wealth creation.

Chartered Wealth Manager (CWM®)

Globally recognised for delivering holistic wealth and estate planning across investments, tax efficiency, succession, and legacy.

What Our Clients Say

Before meeting Nitin, my finances felt scattered — I had some savings here and there, a few random investments. Nitin patiently understood my goals, reviewed my existing portfolio, and created a structured financial plan that actually made sense. Today, I know exactly where I stand, what I’m investing for, and how each step moves me closer to my goals. More than returns, it’s the peace of mind that my money is now working for me with purpose and discipline.

Nitin didn’t jump straight into recommending mutual funds. He first took the time to understand my existing portfolio in detail, explained what was working and what needed realignment, and then suggested the right mix of funds to create a complete, balanced portfolio. He also guided me on how to plan across other investment areas, ensuring that every rupee was invested with purpose and direction.

What I appreciated most about working with Nitin is that he focused on me, not just my returns. I was confused about how to organize and track my investments, but he took the time to understand my goals, family priorities, and comfort with risk. His explanations were clear, his approach structured, and his recommendations purposeful. For the first time, I felt guided — not sold to. It truly feels like a financial plan built around my life, not the markets.

What stood out to me about Nitin is how he looks at the whole picture. He didn’t just suggest new investments — he first studied my existing ones, explained what to keep and what to change, and then aligned everything with my goals. Every year, he reviews and rebalances my portfolio so that I stay on track without worry. I finally feel like I have a long-term financial plan, not just a set of products.

Personal Finance and Wealth Management - Built around your Life, Not products

Mutual Funds | PMS | Long Term Wealth Planning

Personalised Mutual Fund Strategies

For investors who want clarity, discipline, and structure — not random fund picks.

Tailored Portfolios, Strategic Growth

For investors whose finances are growing — and need a strategy that grows with them.

Comprehensive Wealth, Tailored for You

For families and professionals who want their money aligned with life goals, risk, and legacy.

Not sure where you fit? Most clients begin with a conversation — Not a product.

Your Personal Finance Queries, Answered!

Your risk profile is the foundation of your Personal Finance plan. It helps identify whether you’re more comfortable with stable, lower-return investments or willing to take higher risk for higher growth.

Once we know this, we can design a portfolio that matches your comfort level while still working toward your goals.

Personal Finance goals vary for everyone. Short-term goals may include building an emergency fund, buying a car, or saving for a holiday.

Long-term goals often cover retirement, children’s education, or buying a home. Defining these goals helps us allocate the right mix of investments and timelines.

Personal Finance should never feel hidden or complicated.

We ensure full transparency by explaining expense ratios, management fees, exit loads, and any distribution charges upfront.

You’ll always know what you’re paying and why — no surprises.

Diversification is at the heart of Personal Finance. By spreading investments across asset classes like equity, debt, and alternatives, we balance risks and smoothen returns. This way, no single market event derails your entire plan.

Personal Finance planning is not a “set and forget” exercise.

We believe in regular rebalancing so that any life changes — like a new job, higher income, or major expenses — are reflected in your goals. This ensures your plan always stays aligned with both your life and the market conditions.

Market ups and downs are inevitable, but smart Personal Finance planning ensures you’re protected.

By aligning investments with your risk profile, keeping a safety buffer, and focusing on long-term goals, we help you stay invested confidently — even when markets fluctuate.

Book your 1 Hour Free Call - To Gain clarity on your Wealth. No Commitment

Exploring the Latest Trends in Personal Finance

Smallcases in the Context of Wealth Management in India

In wealth management, investments are not evaluated in isolation. Portfolios are built through structured asset allocation designed to balance growth, stability, and long-term goals. Within

Emergency Fund: Where Should You Park It in India ?

Most people focus on building an emergency fund. Very few think about where to keep it. And that decision quietly makes a difference. If your

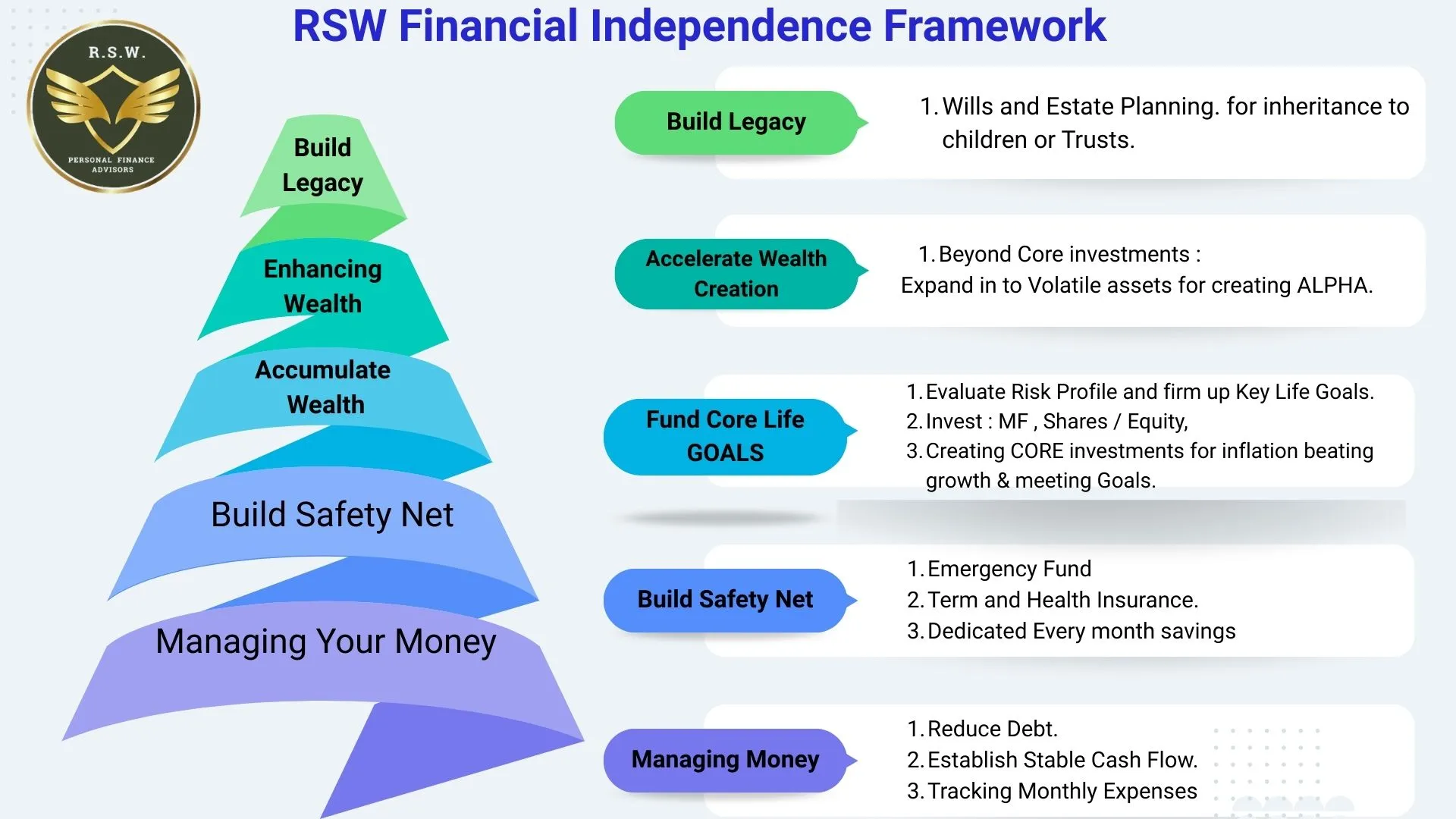

Wealth Planning Framework for Salaried Professionals in India

If you are a salaried professional between 30 and 50, wealth creation is no longer optional — it is strategic. Generate Income.Allocate CapitalThink Ahead But