A SIP is a plan of investing in mutual funds in which you invest a fixed amount in them on a regular basis, like monthly, quarterly, or at such a frequency which you are comfortable with.

A SIP is a mode of investment for wealth creation over time by taking advantage of market fluctuation.

Over the long period, it does a thing called rupee cost averaging; more units are bought when prices are down, and less when the prices are up.

This disciplined approach encourages long-term investing, reduces the risk of timing markets, and helps achieve your financial goals steadily and systematically.

The article explores the various types of SIP strategies, the parameters to keep in mind while choosing the appropriate strategy and how Mutual Fund advisor will be able to effectively guide you on choosing the appropriate strategy.

Following are the 5 Types of SIP:

7 Parameters to consider while choosing the SIP

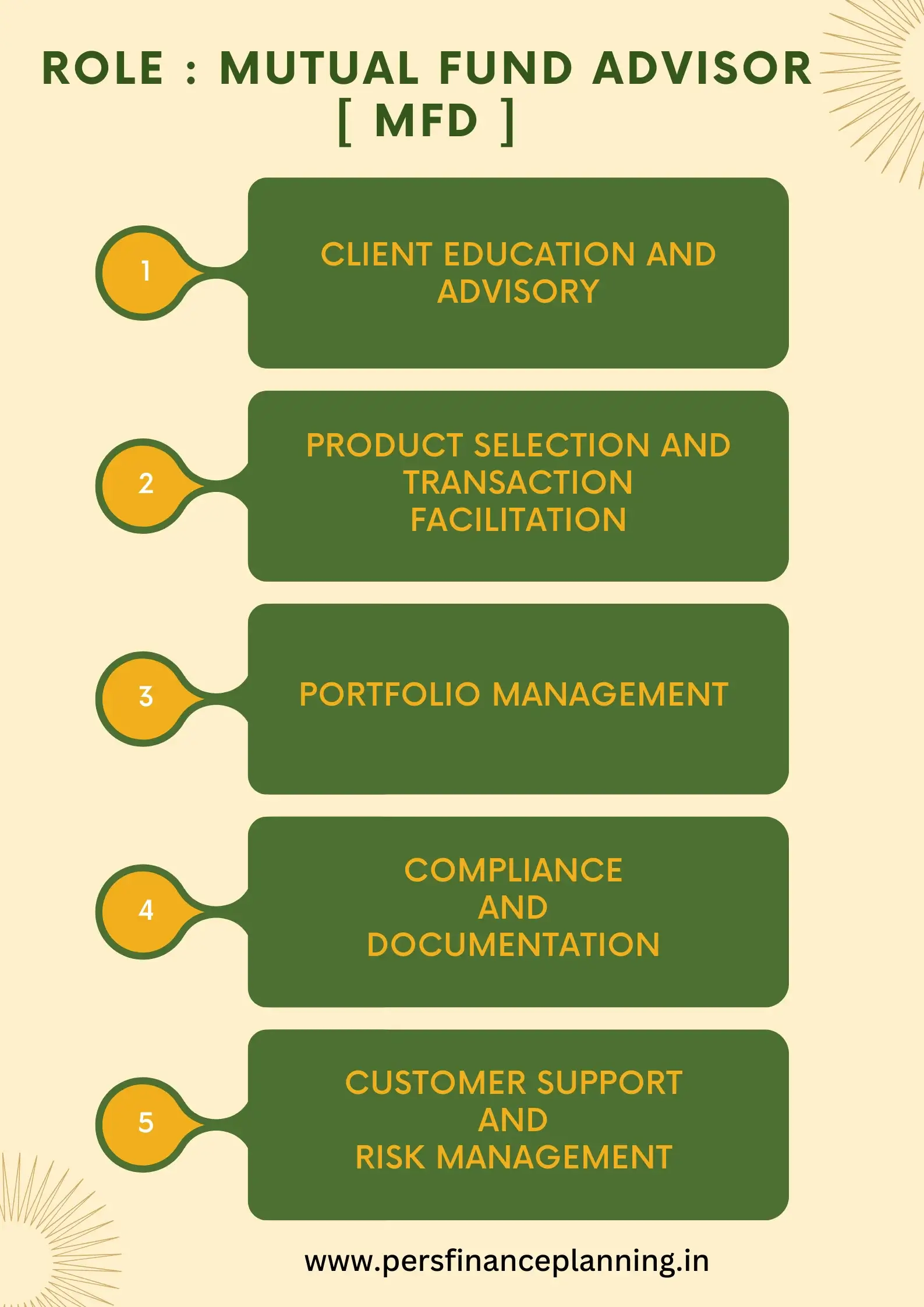

Role of a Mutual Fund Advisor

Mutual Fund Advisor will professionally guide you on the right mutual funds and the right type of SIP that is suitable for your financial goals.

His experience and knowledge will enable him to design an investment strategy commensurate with your risk tolerance, investment horizon, and financial objectives.

His ability could help you make informed choices on your investments that would optimize returns and minimize risks.

How to Effectively Use Services of MFD ?

The Mutual Fund Distributor strategically plans your investments with a focus on the following key essentials:

Financial Goals Alignment:

The investments they make align with the specific goals you need to achieve financially, especially in saving for retirement, education, or wealth creation.

Personalized Risk Management:

They define your risk tolerance level and design a portfolio that generates a balance between possible returns and an acceptable level of risk.

Optimized Asset Allocation:

Asset classes are diversified in a way that maximizes returns while minimizing risks, ensuring you have a well-diversified portfolio.

Adaptation to Life Events:

Regularly review and adjust the investment strategy on important life events, like marriage, children, or career changes, in order to keep the financial plan on course.

Maximizing Tax Efficiency:

They will structure your investments in a way that increases the chances of maximizing tax benefits, thereby ensuring you get to keep more of your earnings and grow wealth effectively.

Book an Appointment