What is financial freedom, and why is it important?

Financial freedom is not just about wealth accumulation; it's the liberation from financial worries, enabling you to pursue your passions and live life on your own terms.

It's the foundation upon which you can build a life rich in experiences, relationships, and meaningful contributions.

It provides peace of mind by ensuring resources are available to handle unexpected expenses or emergencies, empowering individuals to live life on their terms.

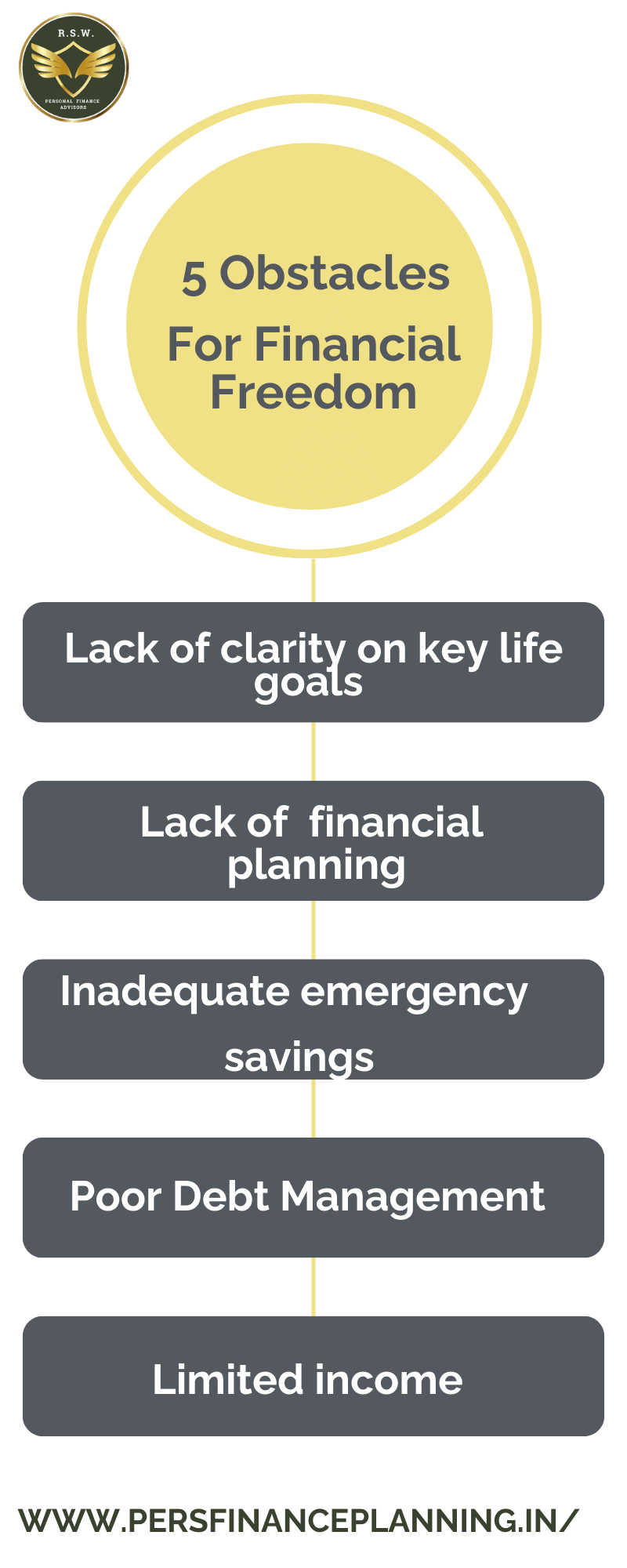

What are some common obstacles people face on the journey to financial freedom, and how can they overcome them?

Key steps to achieve Financial Freedom.

Importance of Financial Planning

Personal financial planning is like creating a roadmap for your finances.

- Financial planning helps take control of your financial future and make informed decisions.

- Financial planning involves setting goals for your money, such as buying a car or retiring comfortably.

- It requires developing a plan through budgeting, saving, investing, and managing debts effectively..

- The goal of financial planning is to ensure you're on track to meet your financial objectives.

Financial Planning and Freedom:

Need for an advisor for personal finance planning.

Investment Options In India : Govt Backed

| Govt Backed or Controlled or Influenced Investments: | Why Invest in these ? |

|---|---|

| Public Provident Fund (PPF) | 1. Offers tax benefit under 80C and falls under EEE category. 2. Interest rate is compounded annually 3. Exempts initial investment, interest amount, and withdrawal amounts 4. Provides higher returns than traditional savings accounts 5. Attractive option for stable long-term returns |

| Post Office Monthly Scheme. | 1. Offers guaranteed returns on investment 2. Provides fixed interest rate determined by the government 3. Backed by the government and widely accessible through post offices in India 4. Considered low risk, appealing to conservative investors 5. Attractive option for predictable income and capital preservation |

| Govt Bonds. | 1. Ideal for retail investors seeking portfolio diversification 2. Government Bonds are risk-free due to sovereign guarantee 3. Sovereign guarantee nullifies credit riskProvides stability and security in investment 4. Suitable for long-term investment strategies |

| National Pension Scheme [ NPS ] | 1. Designed to help build a retirement corpus 2. Offers tax benefits under Sections 80C and 80CCD(1B) of the Income Tax Act 3. Provides flexibility in choosing investment options and fund managers 4. Empowers investors to tailor their portfolio according to risk tolerance and financial goals 5. Offers financial security and stability during post-employment years |

| Sukanya Samruddhi Scheme. | 1. Offers Tax Benefit under 80C. 2. Rare investment which is under EEE Category. EEE Category. EEE Category : Initial investment amount, interest amount, and withdrawal amounts all are exempt. |

| Sovereign Gold Bonds [ SGB ] | 1. Sovereign Gold Bonds (SGBs) are issued by the RBI for the Government of India. SGBs are linked to the market price of gold 2. They offer 2.5% annual interest and have an 8-year maturity. 3. There is an option for premature redemption after 5 years. SGBs provide an opportunity to invest in gold without physical ownership |

Investment Options In India : Market Related

| Other Options : | |

| Mutual Funds [ MF's ] | 1. MF's offer diversification across stocks, bonds, and other assets to spread risk. 2. Professional fund managers provide expertise in analyzing markets and managing portfolios. 3. Diversification can reduce market volatility and enhance long-term growth. 4. Professional management helps investors navigate changing market conditions.Investors save time and effort by relying on professional fund managers. |

| Gold Exchange-Traded Funds [ ETFs ] | 1. Gold ETFs track the price of physical gold in the local market 2. They invest in 99.50% pure gold bullionInvestors can profit from positive price movements in gold without storing physical gold 3. Gold ETFs are passively managed funds. They provide a convenient way to invest in gold |

| Corporate Bonds | 1, Corporate bonds provide a predictable income stream through regular interest paymentsInvesting in corporate bonds can help diversify an investment portfolio. 2. Corporate bonds typically have a low correlation with other asset classes like stocks 3. Corporate bonds are generally considered less volatile than equities. 4. They offer a way to manage overall portfolio risk while potentially generating competitive returns |

| Direct Investment in Shares: | 1. Shares offer potential for significant capital appreciation over time. 2. Investing in shares allows investors to participate in the growth potential of the underlying companies 3. Ownership of shares entitles investors to share in the company's profits through dividends. 4. Dividends provide investors with regular income in addition to the potential for capital appreciation. 5. Investing in well-performing companies can lead to substantial returns on investment |

My Mission...