"Why Choose a professional Mutual Fund Distributor [MFD] services?"

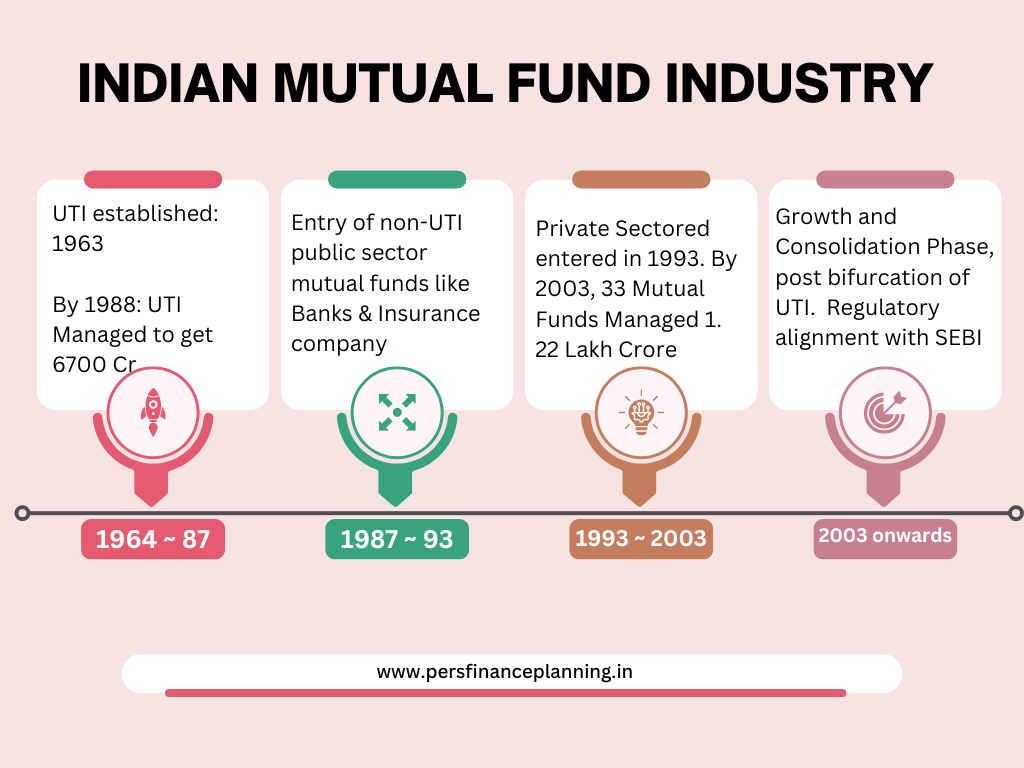

Let's delve into the detailed reasons why one should consider the services of an MFD. Before answering the above questions let us look at evolution of Mutual Fund Industry in India.

Brief introduction to mutual funds and their importance in financial planning.

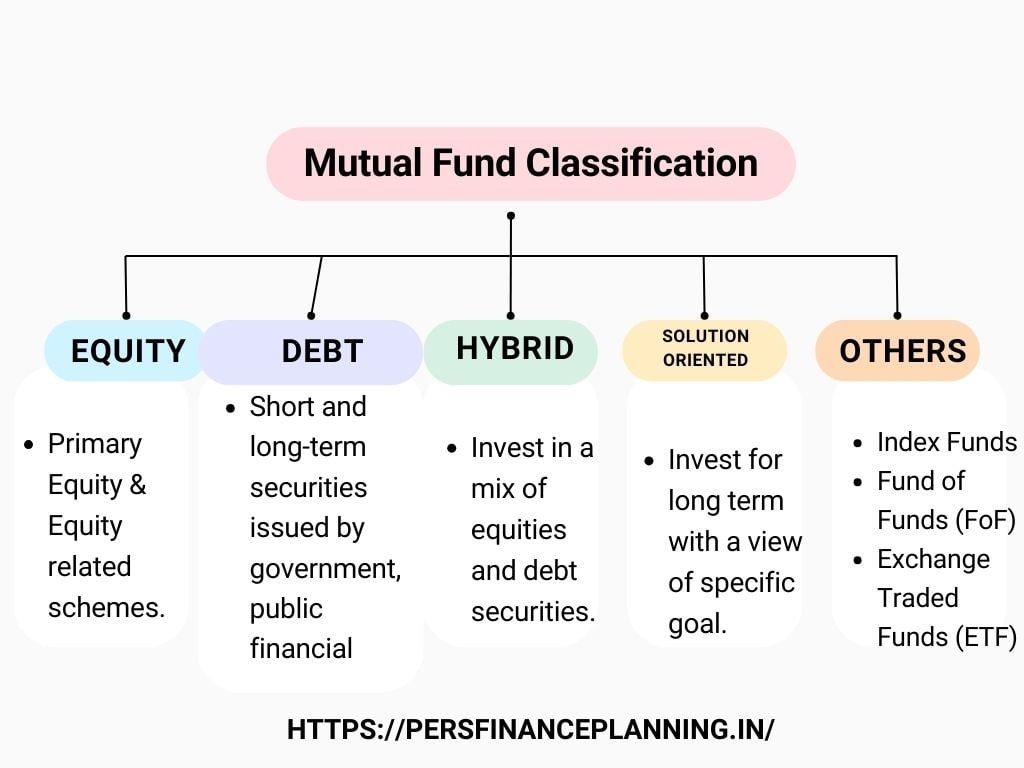

Types of Mutual Funds

In October 2017, SEBI introduced new regulations aimed at reworking and simplifying the mutual fund industry. They were designed to bring in more clarity and coherency into the mutual fund industry.

Every single mutual fund company had implemented the new rules, making sure that everything was compliant across the board by June 2018.

Since then, many mutual funds experienced changes; some merged with others, and others had modifications in the way they functioned or their nomenclature.

The broader goal of such regulations was to provide an environment of transparency for ease of comprehension by investors. SEBI's goal was to develop a more secure and highly accessible investment regime for investors to confidently make informed decisions.

SEBI took these measures to empower the investors and induce more confidence and participation in the mutual funds market.

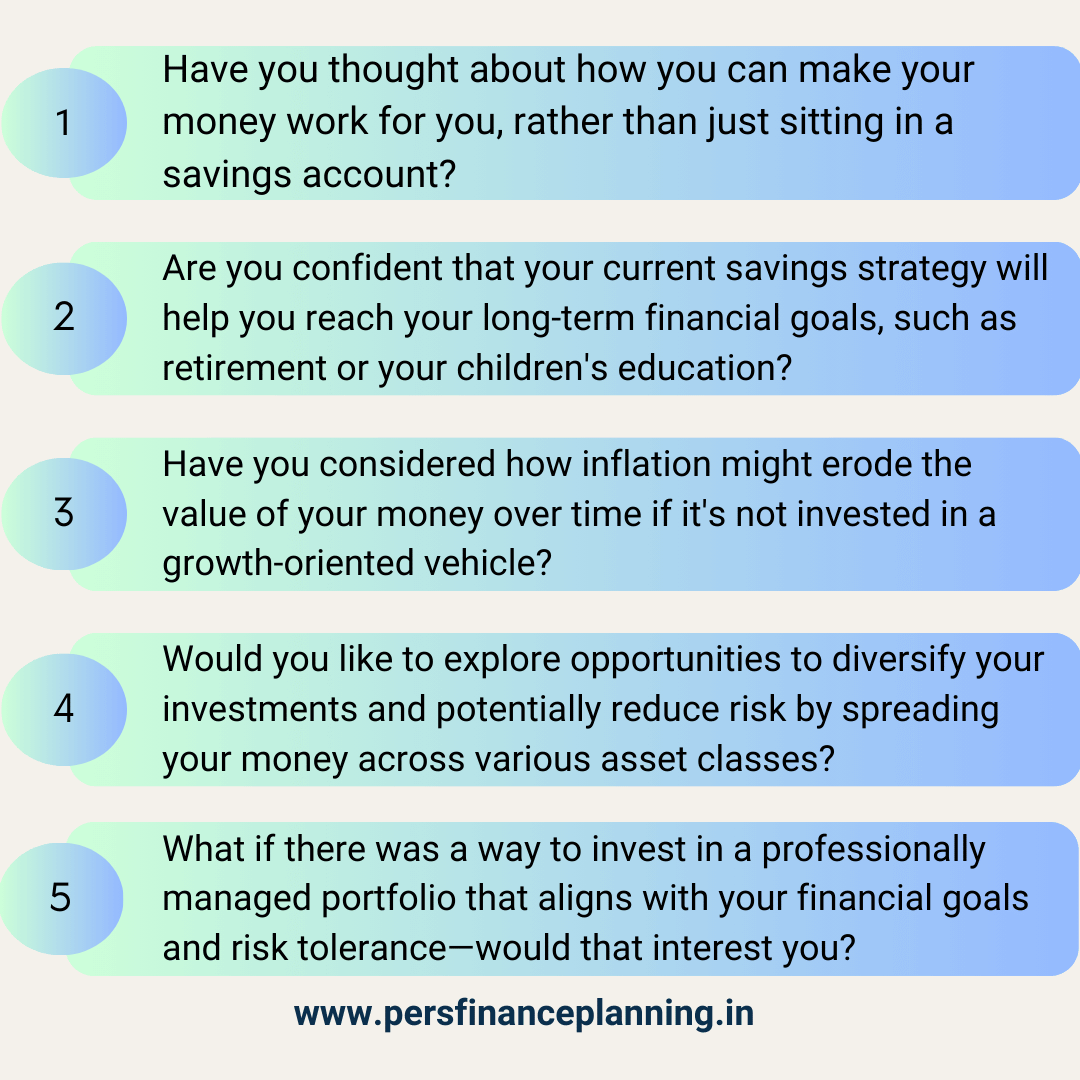

Why You Need a Mutual Fund Advisor : Navigating the Mutual Fund Landscape:

As of Oct 2023, there were 1339 Open Ended Mutual Fund Schemes, 110 Close Ended Mutual Fund and 12 Interval Mutual Fund Schemes

As on April 2024, in FY23, financial year saw a surge in NFOs (new fund offers), with an impressive 176 new mutual funds launched, including 114 equity funds—the highest number in the last five years.

These new funds attracted substantial inflows, securing a remarkable Rs 39,427 crore from investors as of February 2024, making it the second-highest year for inflows after FY2022.

With 17 categories and approximately 1,400 funds available, the choices are vast.

Which one is right for you?

First of all, why are there so many funds?

Which one will allow you to safely park your money while it grows and beats inflation to help you meet your financial goals?

A Mutual Fund Advisor can answer all your queries.

A New mutual fund investor needs answer following questions:

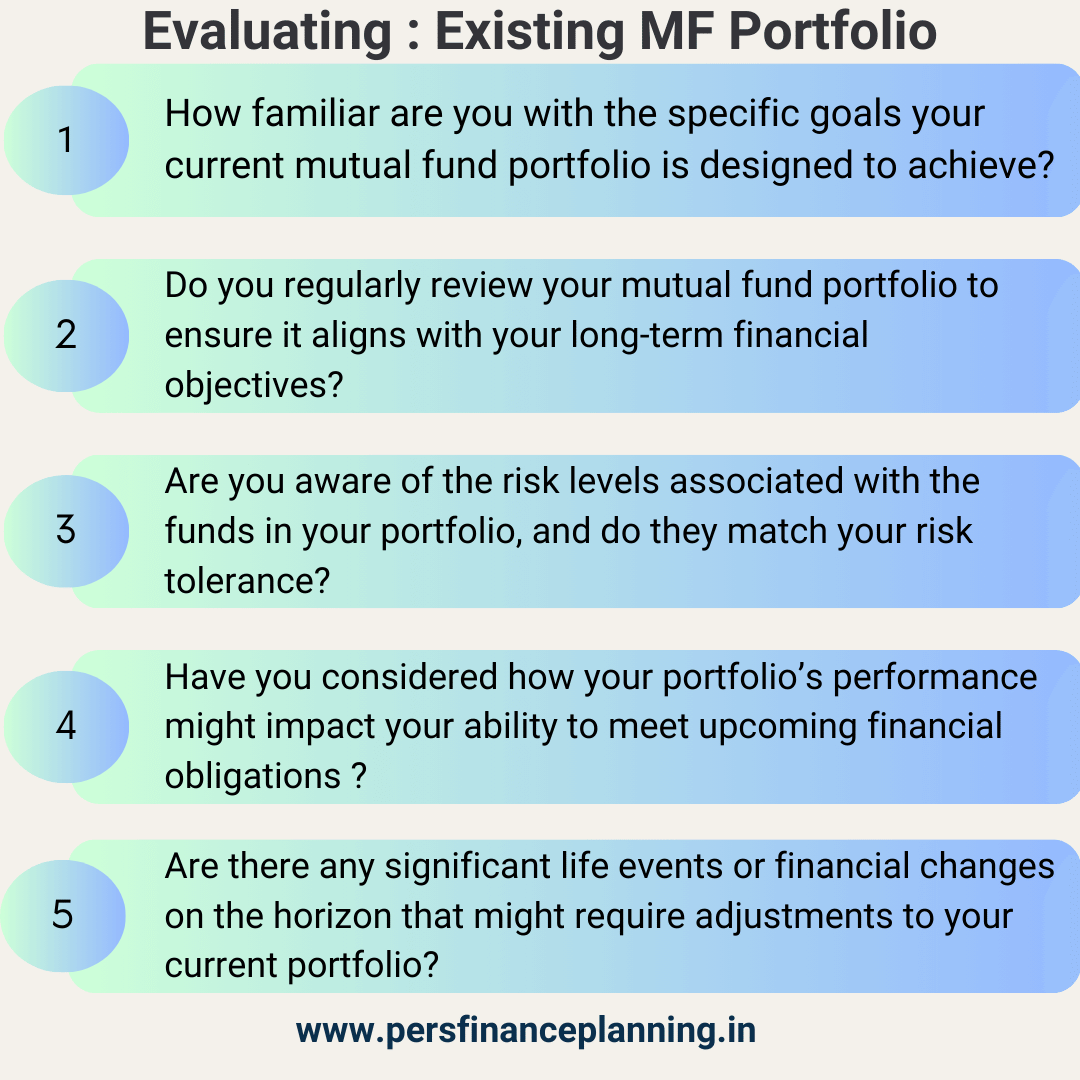

An Existing Mutual Fund Investor should ask following questions :

Certifications and qualifications required to become an Mutual Fund Distributor

To become a Mutual Fund Distributor (MFD) in India, specific certifications and qualifications are required to ensure competency and professionalism. The primary certification needed is the AMFI (Association of Mutual Funds in India) certification.

AMFI Certification

- NISM Series V-A: Mutual Fund Distributors Certification Examination

- Description: This is a mandatory exam conducted by the National Institute of Securities Markets (NISM) for aspiring mutual fund distributors.

- Content: Topics include mutual fund basics, structure, legal and regulatory environment, distribution practices, accounting, valuation, taxation, and investor services.

- Continuing Professional Education (CPE)

- Ongoing Learning: Distributors must participate in CPE programs every three years to maintain the validity of their AMFI certification, staying updated with the latest regulations, market trends, and best practices.

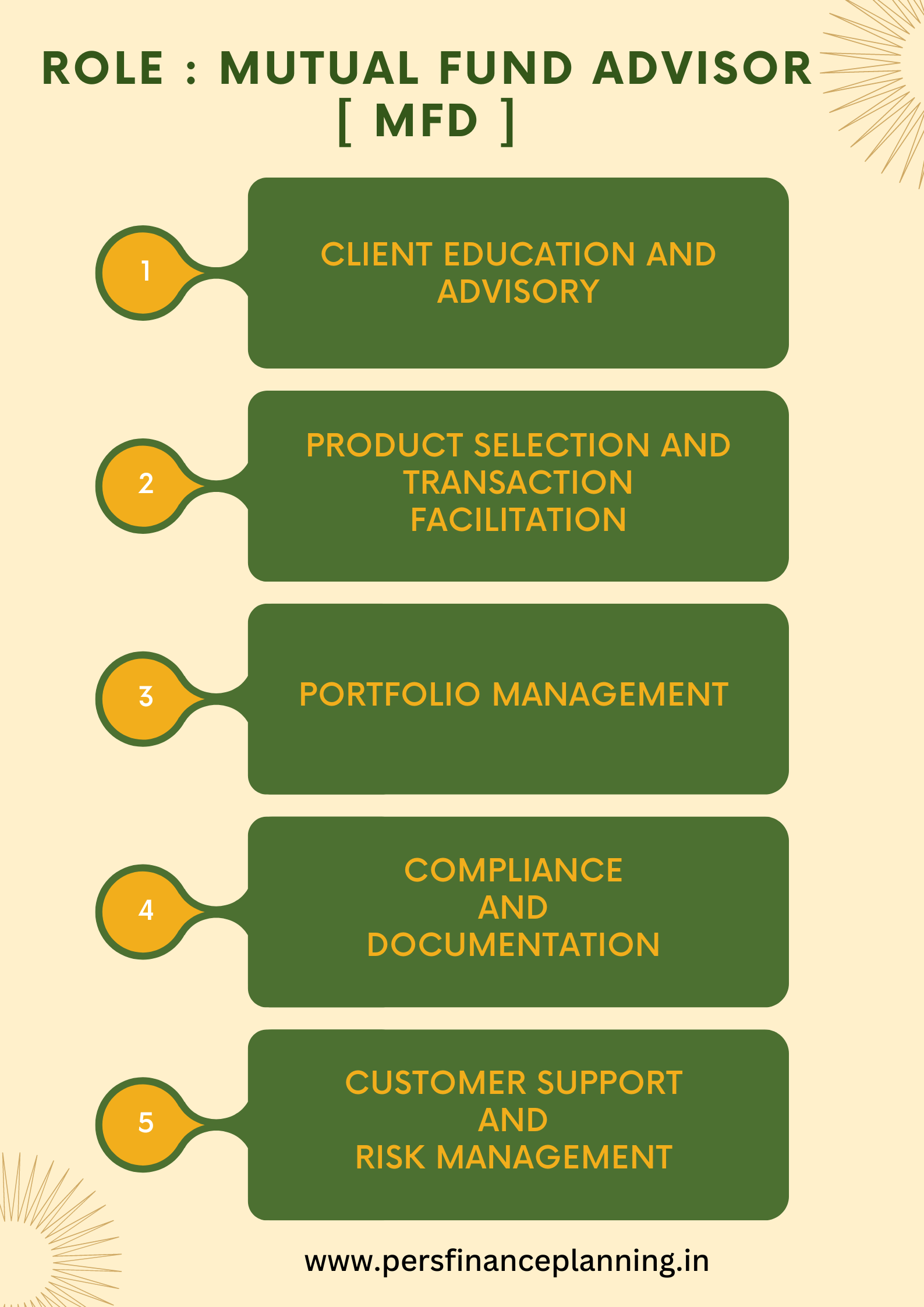

Role of Mutual Fund Advisor

MFD's and Personalised Investment Strategies

As a Certified Mutual Fund Distributor, I will help you answer the above questions and set you on a path of Financial Freedom.

Book an Apppointment.